Down Payment Assistance Programs offer invaluable support to repeat homebuyers across the United States. These programs provide financial assistance to help cover the upfront costs associated with purchasing a home, making homeownership more accessible and affordable for individuals looking to buy a home again. Each state in the U.S. has its own unique Down Payment Assistance Programs tailored to the specific needs and requirements of repeat homebuyers, offering a range of options to support individuals in achieving their homeownership goals.

Unlocking Opportunities: Down Payment Assistance For Repeat Homebuyers

For many individuals and families, buying a home is a significant milestone in life. However, the prospect of down payment can become increasingly daunting, especially for repeat homebuyers. Fortunately, the availability of down payment assistance programs offers a solution that can ease the financial burden experienced during this process.

Understanding Down Payment Assistance Programs

Down payment assistance (DPA) programs are financial aid initiatives that help homebuyers with their initial costs when purchasing a property. These programs are designed to bridge the gap between the homebuyer’s savings and the amount needed for a down payment, making homeownership more accessible.

Why Are These Programs Important for Repeat Homebuyers?

Many repeat homebuyers may assume they do not qualify for DPA programs because they have purchased homes in the past. However, down payment assistance for repeat homebuyers can be incredibly beneficial, as it helps them afford a new home, whether due to growing families or lifestyle changes. These programs can save thousands of dollars and make homeownership more feasible even for those already in the market.

Types of Down Payment Assistance Programs

- Grants: Funds that do not need to be repaid.

- Loans: Low-interest loans that must be repaid over time.

- Deferred Payment Loans: Loans that are repaid only when the home is sold or refinanced.

- Matched Savings Accounts: Funds matched by a program that help increase savings for a down payment.

Eligibility Criteria for Down Payment Assistance Programs ⚖️

To qualify for down payment assistance, repeat homebuyers typically need to meet certain criteria. Here is what to consider:

- Income Limits: Most programs have income threshold limits, which vary by location and family size.

- Homebuyer Education: Some programs require completion of a homebuyer education course.

- Purchasing a Primary Residence: The assistance is generally available only for primary homes, not vacation homes or investment properties.

- Credit Score: Many programs set a minimum credit score requirement.

How to Get Started With Down Payment Assistance

Getting started with down payment assistance for repeat homebuyers can be simple if you know the steps to take. Here are some key actions to consider:

- Research Available Programs: Start by exploring local DPA programs and their requirements. Websites like Resident Action Project provide useful information.

- Get Pre-Qualified: Contact lenders and get pre-qualified for your mortgage. They can also guide you on DPA.

- Complete Education Courses: Take any required homebuyer education courses to enhance your understanding of the purchasing process.

- Submit Applications: Complete applications for the available DPA programs and gather necessary documentation.

Benefits of Using Down Payment Assistance as a Repeat Homebuyer

The advantages of utilizing down payment assistance for repeat homebuyers include:

- Lower upfront costs, making it easier to transition into a new home.

- Accessibility to larger homes or better neighborhoods for growing families.

- Reduction of overall mortgage amounts, leading to lower monthly payments.

- Providing opportunities to rebuild equity quicker in the new home.

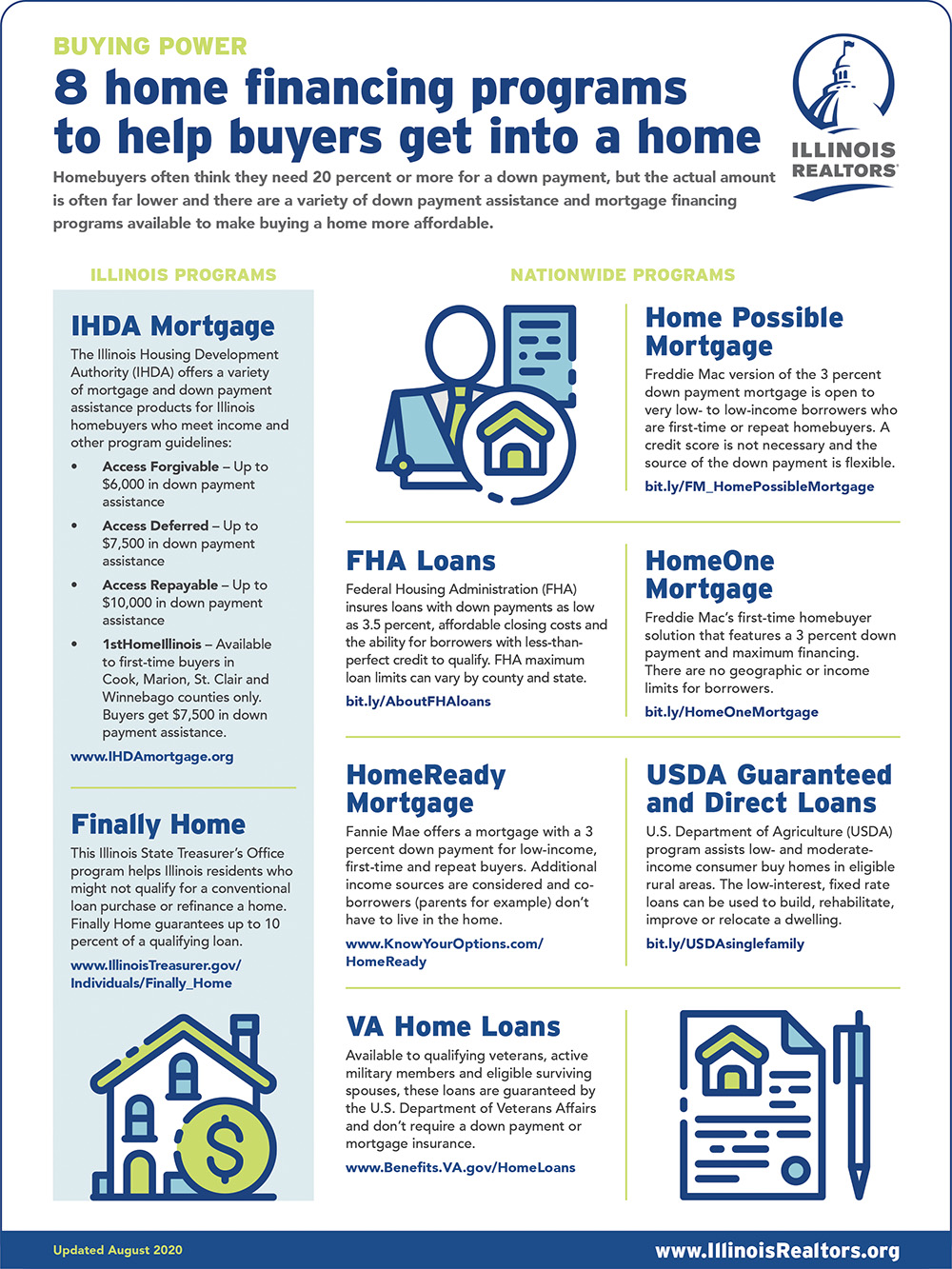

Financial Assistance by State

While many DPA programs exist nationally, eligibility, terms, and available funds vary from state to state. Here’s a brief overview:

- California: Offers various grants and deferred loans for repeat buyers.

- Texas: Provides down payment assistance through grants and low-interest loans.

- Florida: Features programs that cater specifically to first-time and repeat homebuyers alike.

Explore programs specific to your state by visiting official channels like the U.S. Department of Housing and Urban Development (HUD).

FAQs About Down Payment Assistance for Repeat Homebuyers

1. Can I receive down payment assistance if I have sold a home before?

Yes! Many DPA programs are available specifically for repeat homebuyers, allowing you to benefit from assistance regardless of previous homeownership experience.

2. How much can I expect from down payment assistance?

Assistance amounts typically vary by program. For specific details about coverage, visit this resource.

3. Do I need to be a first-time homebuyer to qualify?

No, most programs are open to repeat buyers as well. Check with local programs to determine eligibility requirements.

4. How do I find the right down payment assistance program for me?

Start by researching local options, talking to real estate agents, and exploring resources like this helpful guide.

Empower Yourself with Down Payment Assistance

down payment assistance for repeat homebuyers opens doors to new opportunities in the housing market. By understanding the various programs, eligibility criteria, and taking the right initial steps, you can significantly reduce the financial strain of purchasing your next home.

Make informed decisions and explore your options today! Check out our detailed resources to get the help you need:

What Are Down Payment Assistance Programs? and How Does Down Payment Assistance Work?.