Low-Income Homebuyer Assistance Options provide crucial support to individuals and families aiming to purchase a home in the United States. These programs offer valuable resources such as down payment assistance, low-interest loans, and counseling services to help low-income individuals overcome financial barriers to homeownership. By facilitating access to affordable housing and promoting financial literacy, Low-Income Homebuyer Assistance Options play a vital role in promoting sustainable homeownership and fostering economic stability within communities.

Low-Income Homebuyer Assistance Options in the U.S.

Achieving homeownership is a dream shared by many, yet for low-income individuals and families, this dream can often feel out of reach. Fortunately, there are various low-income homebuyer assistance options designed to help you navigate the complexities of purchasing a home. This article explores the diverse homebuyer assistance programs available to empower low-income homebuyers.

Understanding Low-Income Homebuyer Assistance Programs

Homebuyer assistance programs are tailored to assist individuals and families who may struggle with traditional financing methods due to limited income. These programs can provide financial resources, educational options, and even tax credits that can significantly mitigate costs associated with purchasing a home.

Types of Low-Income Homebuyer Assistance

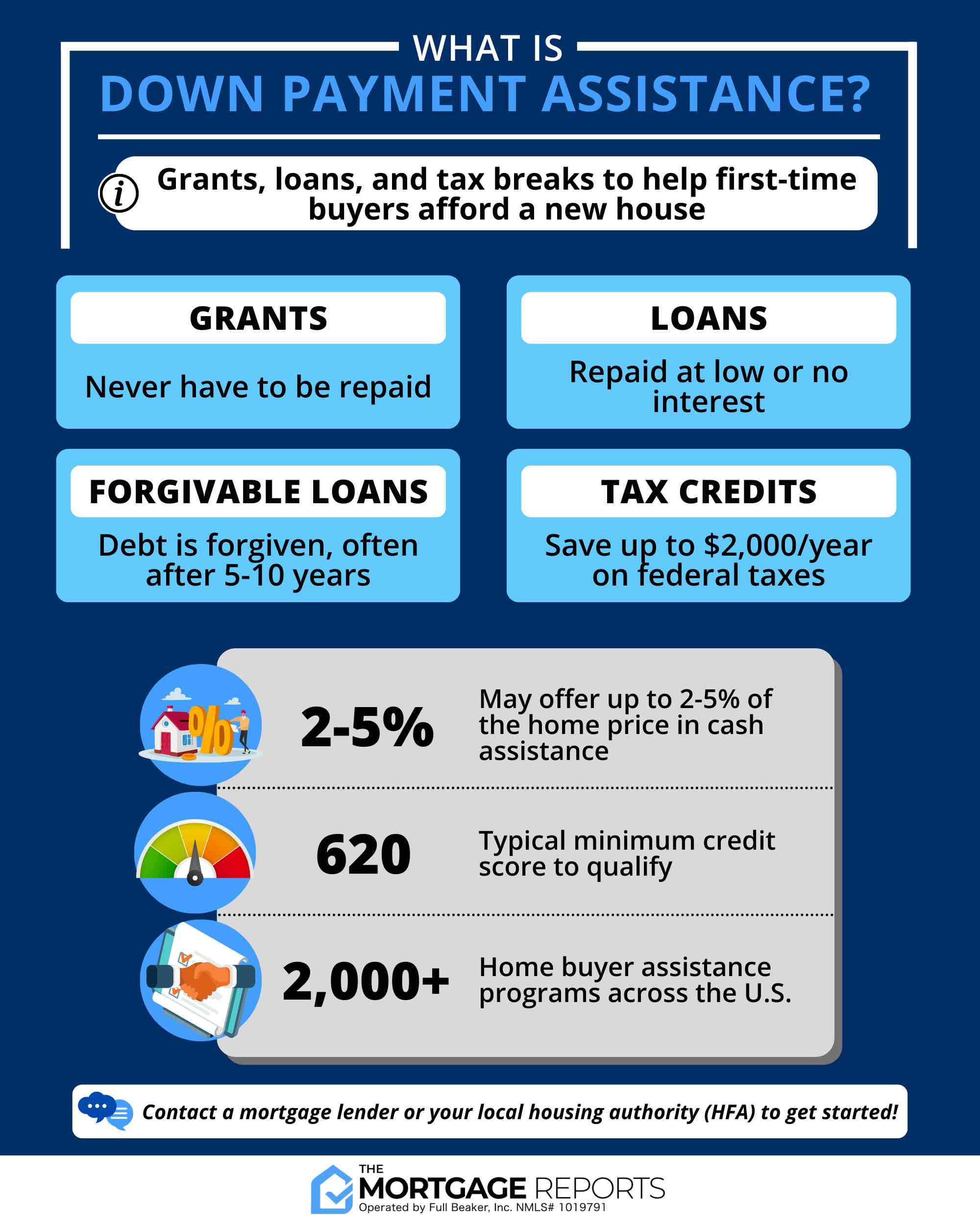

There are several types of homebuyer assistance options available to low-income families, including grants, loans, and tax credits. Below, we delve into some of these options, offering insights into how they work and their potential benefits.

1. Down Payment Assistance Programs

One of the most significant obstacles for low-income homebuyers is the need for a down payment. Luckily, various down payment assistance programs can help bridge this gap. These programs can be offered by local governments, non-profits, and even state housing finance agencies.

Many of these programs provide either grants that do not require repayment or low-interest loans that help cover down payment and closing costs. To learn more about how much down payment assistance you could qualify for, visit this resource: Down Payment Assistance Guide.

2. Federal Housing Administration (FHA) Loans

The FHA provides various loan options that are particularly beneficial for low-income borrowers. FHA loans require a lower down payment—sometimes as low as 3.5%—which makes homeownership more accessible for families. With lower credit requirements, these loans can be a good fit for first-time homebuyers as well.

3. Community Development Block Grant (CDBG) Program

The CDBG program is a valuable federal initiative that funds a wide range of community development and housing activities, including homebuyer assistance. Local municipalities can allocate these funds towards helping residents with affordable housing options, offering loans and grants to qualified low-income homebuyers.

4. USDA Rural Development Loans

If you’re considering buying a home in a rural area, a USDA Rural Development Loan may be a perfect option. These loans are zero-down payment mortgages designed for low-income individuals buying homes in designated rural areas. Additionally, some grants may be available to further help cover closing costs, making homeownership even more viable.

To get started with your application for homebuyer assistance, check out this guide: How to Apply for Homebuyer Assistance Programs.

Additional Assistance Resources

Aside from federal and state programs, various local organizations and non-profits offer their resources targeted at assisting low-income homebuyers. These may include:

1. State Housing Finance Agencies

Each state has its own housing finance agency, which may provide competitive loans, grants, and resources tailored to low-income homebuyers. Reach out to your local agency to find out the specific programs available in your state.

2. Local Non-Profits

Local non-profits, such as Habitat for Humanity, provide a range of services to help low-income families purchase homes. These organizations may offer financing, housing education workshops, and direct construction assistance.

3. Homebuyer Education Classes

Many assistance programs require participants to complete a homebuyer education course. These classes cover essential topics like budgeting, mortgage options, and the intricacies of home maintenance. Engaging in homebuyer education can make a significant difference in your journey toward homeownership.

If you’re curious about the top first-time homebuyer assistance programs, visit: Top First-Time Homebuyers Assistance Programs.

How to Qualify for Low-Income Homebuyer Assistance Programs

Qualifying for low-income homebuyer assistance options often involves meeting specific income limitations, creditworthiness, and other eligibility factors. Here’s what you typically need to do:

- Check Income Limits: Each program has specific income limits based on your area’s median income. Ensure your income falls within the designated threshold.

- Improve Your Credit Score: While many programs have flexible credit requirements, having a better credit score can enhance your loan prospects.

- Provide Documentation: Be prepared to provide documentation such as pay stubs, tax returns, and bank statements to assess your financial situation.

Next Steps

If you’re ready to take the plunge into homeownership and believe low-income homebuyer assistance programs could be your ticket, it’s time to take action. Start by researching the programs available in your local area and determine what you qualify for. Understanding your options is crucial in this process.

To learn more about how to get assistance buying a home, please explore our comprehensive resource: How to Get Assistance Buying a Home.

achieving homeownership as a low-income individual or family is indeed possible, thanks to various homebuyer assistance options available throughout the U.S. By leveraging the resources provided by government programs, non-profits, and community organizations, you can transform your dream of owning a home into a reality. Don’t hesitate to reach out for assistance and explore what programs work best for your unique situation!