If you’re planning to buy your first home but struggling to save enough money, understanding how to get down payment assistance could make all the difference. Across the U.S., state and local governments offer programs that provide financial support to cover your down payment and closing costs. These programs are designed to help make homeownership more accessible—especially for first-time buyers, low-to-moderate income households, and veterans.

❓ What Is Down Payment Assistance?

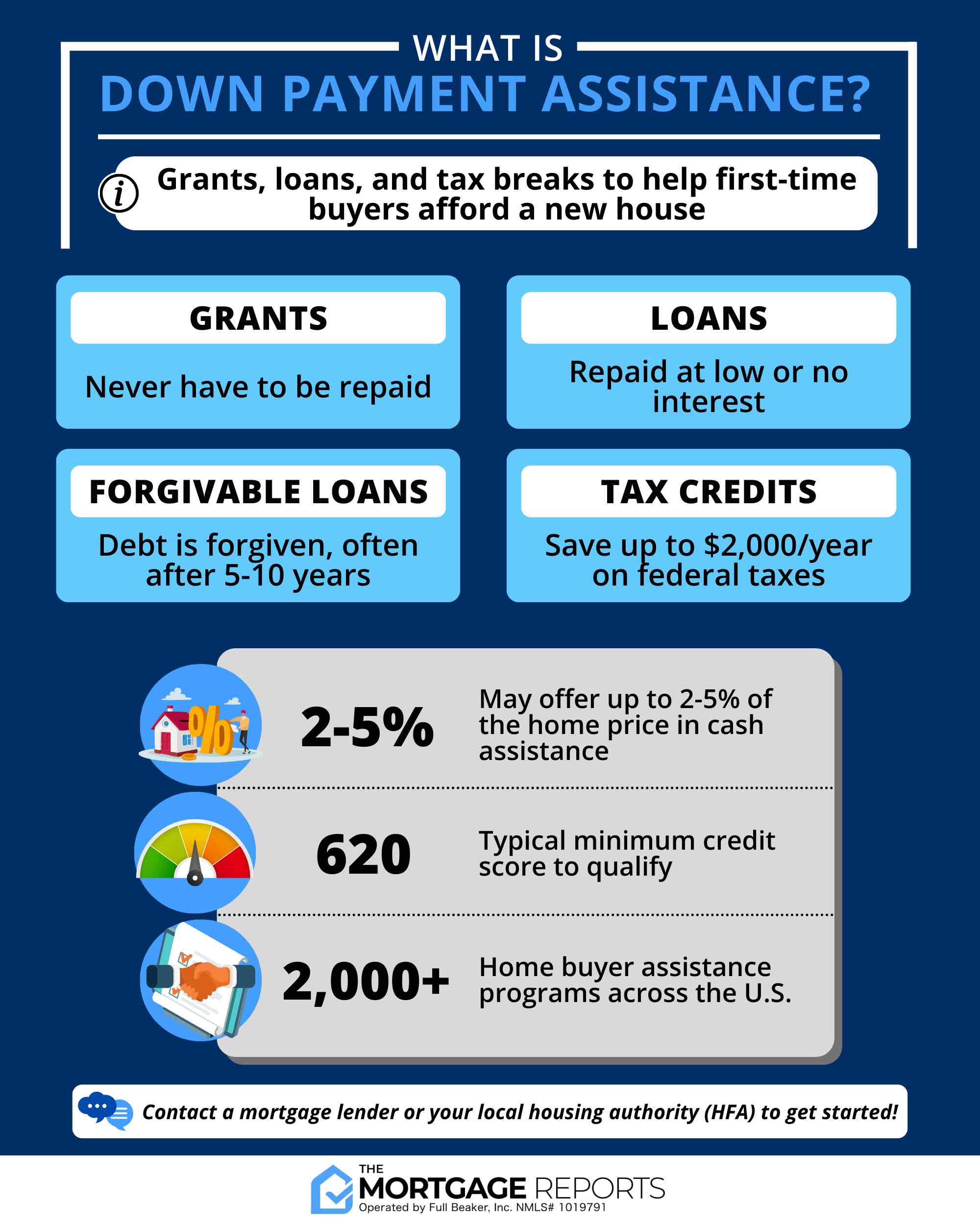

Down payment assistance (DPA) is financial help that comes in the form of a grant, loan, or forgivable second mortgage. It helps buyers cover part or all of their down payment and/or closing costs when purchasing a home. DPA programs are typically offered by:

- 🏛️ State Housing Finance Agencies (HFAs)

- 🏢 Local governments and municipalities

- 🏦 Non-profit housing organizations

- 👨🏫 Employers and educational institutions

✅ Who Can Apply for DPA?

While eligibility rules vary, you may qualify if you:

- 👨👩👧👦 Are a first-time homebuyer (or haven’t owned in the last 3 years)

- 📍 Purchase a primary residence

- 📉 Meet income and purchase price limits based on your location

- 📘 Complete a homebuyer education course

- 💼 Work with a lender approved by your state housing authority

📝 How to Get Down Payment Assistance – Step by Step

- 📞 Find your state housing agency: Look up programs in your state. Most offer DPA grants or second loans.

- 💼 Contact an approved lender: They will guide you through both your mortgage and the DPA application.

- 🎓 Take a homebuyer education class: Usually required and helps prepare you for successful homeownership.

- 📂 Gather documents: Tax returns, pay stubs, ID, bank statements, and proof of employment.

- 🏡 Submit your application: Your lender will file both mortgage and DPA paperwork together.

- ✅ Close on your home: Your DPA funds will be applied at the time of closing.

💡 Types of Down Payment Assistance Programs

- 🎁 Grants: Free money you never repay

- 🏦 Deferred second mortgage: No payments until you sell or refinance

- 📉 Low-interest loans: Paid monthly along with your mortgage

- 📝 Forgivable loans: Automatically forgiven after 5–15 years of occupancy

📍 Where to Find DPA Programs

Here are some examples of programs available by state:

- 💵 Texas DPA Programs

- 🏠 California DPA Programs

- 📍 New York DPA Programs

- 🌴 Florida DPA Programs

- 🏡 Illinois DPA Programs

❓ Do I Need to Repay DPA?

That depends on the type of assistance you receive. Grants don’t require repayment, while forgivable loans are erased over time. Deferred second loans may be repaid only when you sell or refinance. Be sure to ask your lender about repayment terms.

🔎 Real Buyer Example

Maria, a teacher in Colorado, used a state DPA program to receive $12,000 in down payment assistance. Because she stayed in the home for five years, the loan was fully forgiven—and she never repaid a cent.

📊 Pros and Cons of DPA

| Pros | Cons |

|---|---|

| ✅ Reduces upfront costs | 🔒 Must meet program rules |

| ✅ Easier access to homeownership | 📝 Additional paperwork |

| ✅ May be forgivable | 💲 Can add to loan balance if repayable |

📥 Ready to Apply?

Getting down payment assistance could be the step that makes homeownership possible for you. Start by checking what your state offers and speaking to an approved lender who understands the programs available to you.

🔗 Find Programs by State (HUD Resource)